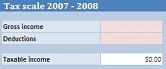

Taxation tables

In The financial wizard's apprentice1, MT Pockets in busy considering the offer of a pay rise.

Open the Tax comparison (.XLSX 71KB) spreadsheet and use it to answer these questions. Record your responses using Microsoft Word or OneNote.

-

Enter the group certificate information and calculate the total tax payable by MT Pockets in the 2007/08 financial year.

-

Write a paragraph explaining why the formula in cell E11 is =IF(AND(D6>=B11,D6<=C11),D11*(D6-C10)+3600," ")

-

MT Pockets has been offered a pay increase to $81K in the financial year of 2008/09. Assume her deductions increased by 5%. Will she pay more or less tax? Justify your response.

-

What would be the effect on MT Pockets 2008/09 net income if her deductions were halved?

-

Write a paragraph comparing the effect of the changes from 2007/08 to 2008/09 on the following income levels:

|

|

|

a. $30,000 - $40,000 b. $75,000 - $80,000 c. Greater than $150,000 |

Be sure to dave your work.

Visit the Australian Taxation Office's How much tax should be taken from my pay?2 website to learn about the current taxation rates for Australian workers. Update your spreadsheet for the current rate, assuming an annual $2,000 pay rise and 5% increase in deductions continues.

Links

- http://www.resources.det.nsw.edu.au/resource/access/44828baf-e540-4c79-9f2c-4ce180432ad9/0

- https://www.ato.gov.au/Individuals/working/in-detail/payg-withholding/how-much-tax-should-be-taken-from-my-pay-/